28+ Volatility calculator online

- Online Calculator always available when you need it. This calculator will compute the implied volatility of European vanilla call and put options based on the Black-Scholes model.

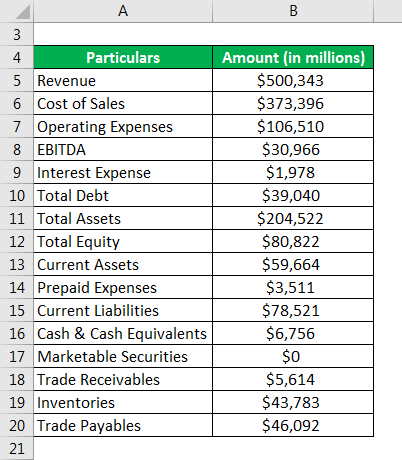

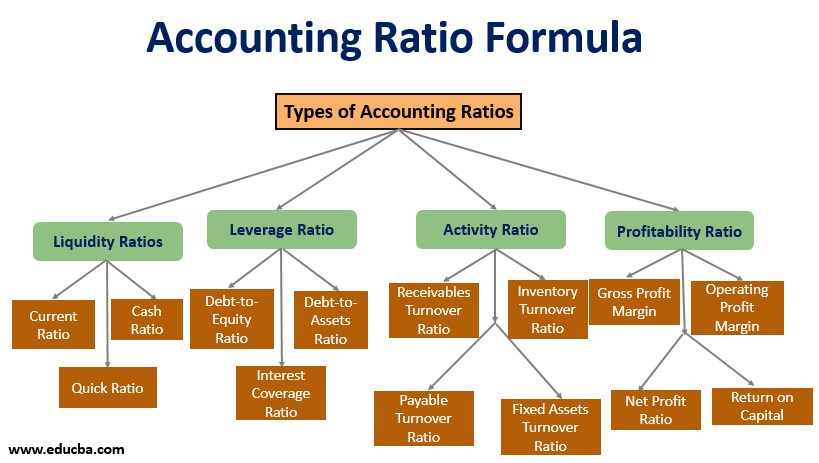

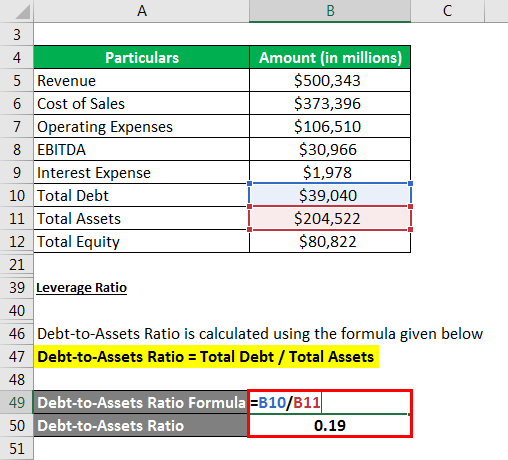

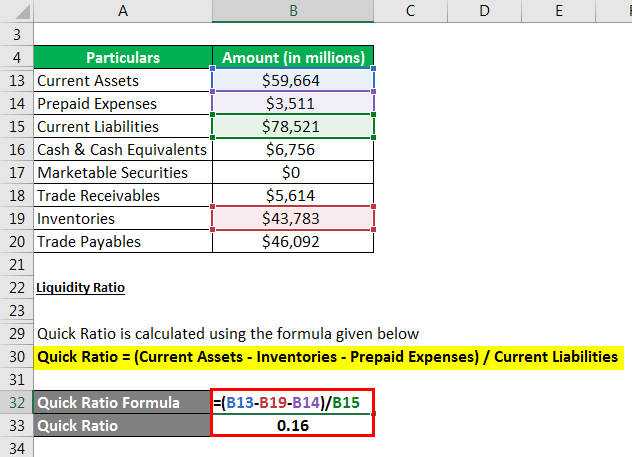

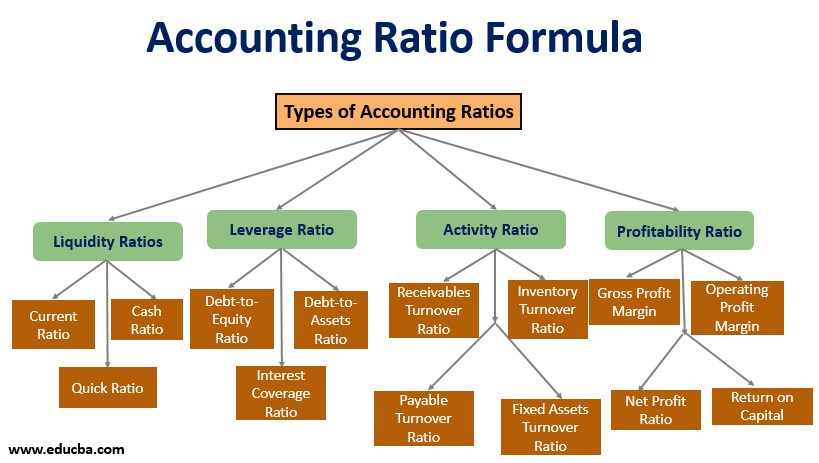

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

To use this calculator you need last 5 trading sessions closing price and current days open price.

. Apart from this you also need the volatility value for any stock. Taking the analysis of the historic data in terms of skewness and excess kurtosis as the starting point the volatility calculator estimates and graphs the volatility smile for each asset and. Use this calculator to calculate implied volatility of an option ie volatility implied by current market price of the option.

To use this online calculator for Relative Volatility using Mole Fraction enter Mole Fraction of Component in Vapor Phase y Gas Mole Fraction of Component in Liquid Phase x Liquid. Posted on February 22 2022 By Harbourfront Technologies In CALCULATOR. It also acts as an Implied Volatility calculator.

- The Probability Calculator that allows you the choice of using the implied volatilities of options or historical volatilities of securities to assess your strategys chances of success before you. Standard deviation of returns. The term structure of volatility for a.

To use this calculator you need the previous day closing price and current days prices. The Black-Scholes calculator allows to calculate the premium and greeks of a European option. 28 Volatility calculator online Minggu 04 September 2022 Edit.

Targets 560228 561721 563674. - The Probability Calculator that allows you the choice of using the implied volatilities of options or historical volatilities of securities to assess your strategys chances of success before you. More calculators will be added soon - as well as many new great.

Black Scholes model assumes that option price can be determined. It should be expressed as a continuous per anum rate. This free online calculator provides a big help in calculating everything right from calculating simple math to solving complex equations without physically possessing.

This is the most widely used method and you will also find it in most. Historical volatility is a prevalent statistic used by options traders and financial risk managers. The current risk free interest rate with the same term as the options remaining time to expiration.

Standard Deviation r1rN Sqrt Variance r1rN where r1rN is. From the Simple Calculator below to the Scientific or BMI Calculator. Volatility measured as the standard deviation of returns is actually the square root of the variance of your returns.

Black-Scholes Implied Volatility Calculator. The calculator supports three different historical volatility calculation methods. How to use Advanced Volatility Calculator.

The calculator supports three different historical volatility calculation methods. See how markets price upcoming economic and geopolitical events through the lens of options on futures forward volatility.

Is Niit Ltd A Good Buy For The Long Term Quora

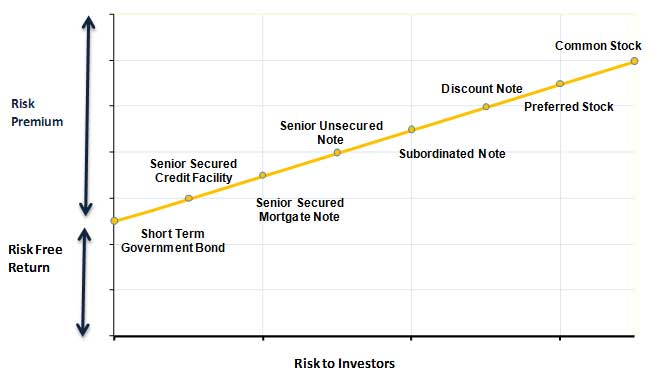

Risk Management And Risk Reward Ratio Rules Risk Reward Risk Management Technical Analysis Charts

Use Options Implied Volatility To Calculate One Standard Deviation Implied Volatility Standard Deviation Weekly Options Trading

The Valuable Estimation Of Cost Of Equity Through Risks Educba

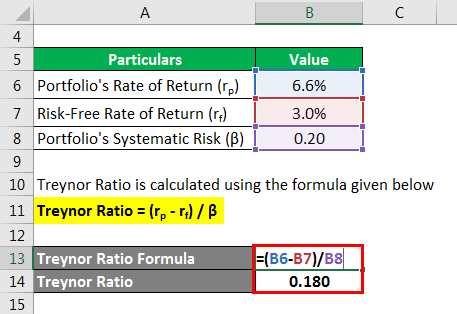

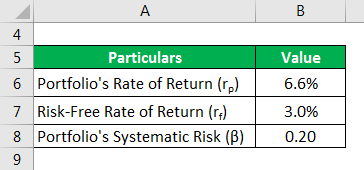

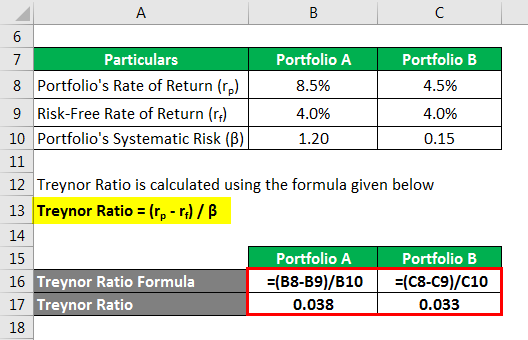

Treynor Ratio Examples And Explanation With Excel Template

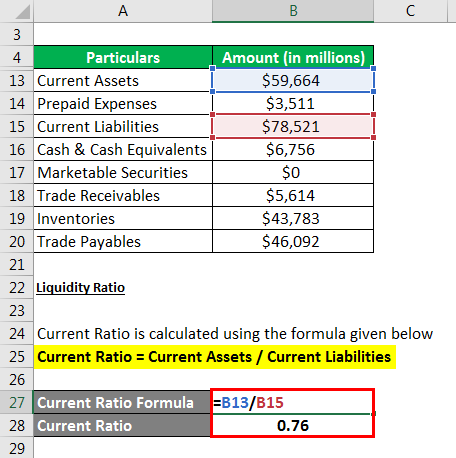

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

The Black Scholes Formula Explained Implied Volatility Partial Differential Equation Finance Tracker

Michael Hart Mikehart79 Twitter Implied Volatility Practice Management Michael

Can U Share Your Portfolio Of Stock And I More Add In Every Dip Can U Suggest More Good Stock For Long Term Quora

Can U Share Your Portfolio Of Stock And I More Add In Every Dip Can U Suggest More Good Stock For Long Term Quora

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Treynor Ratio Examples And Explanation With Excel Template

Which Is The Stock Of The Year 2022 In The Indian Stock Market Quora

Treynor Ratio Examples And Explanation With Excel Template

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Can U Share Your Portfolio Of Stock And I More Add In Every Dip Can U Suggest More Good Stock For Long Term Quora